Top Burgundy and mature Bordeaux have been among the highlights at recent Hong Kong-based auctions by Sotheby’s and Christie’s.

In April, a Sotheby’s auction featuring ‘a remarkable Burgundy cellar’ saw a six-bottle lot of Domaine de la Romanée-Conti, Romanée-Conti Grand Cru 1978 sell for HK$562,500 (£56,600), including buyer’s premium – albeit below the pre-sale high estimate of HK$800,000.

White Burgundies were also prominent in the auction. A 12-bottle collection of Domaine d’Auvenay’s En La Richarde, Puligny-Montrachet 1999 in its original wooden case (OWC) fetched HK$500,000 (high estimate: HK$550,000). Only 1,224 bottles of the wine were produced, said Sotheby’s. Domaine Ramonet, Montrachet 1995 (12x75cl, OWC) sold for HK$300,000 (high estimate: HK$320,000).

Bordeaux’s vaunted 1961 vintage again demonstrated its enduring appeal, with three magnums of Petrus 1961 selling for HK$400,000 (high estimate: HK$400,000).

Fellow auction house Christie’s ran a Hong Kong-based online auction, ending 8 April, and highlights included 12 bottles of Henri Jayer’s Cros Parantoux, Vosne-Romanée 2000, with consecutive bottle numbers. Six two-bottle lots achieved prices ranging from HK$175,000 to HK$200,000, including buyer’s premium (high estimate per lot: HK$220,000).

From Bordeaux, Château d’Yquem, Sauternes 1990 (12x75cl) sold for HK$30,000 (high estimate: HK$30,000). Two 12-bottle lots of Lynch-Bages, Pauillac 5CC 1961 fetched HK$40,000 and HK$32,500 (high estimate per lot: HK$40,000).

Harlan’s Promontory shows big gains

A key index of fine wine secondary market performance, the Liv-ex 100, has increased in value for the first time in 12 months.

Liv-ex, a global marketplace for the trade, said in April that the index crept up by 0.4% in March, although it was still down 14% over 12 months. Meanwhile, the broader Liv-ex 1000 index continued to fall, dipping 0.6% in March.

Promontory 2018, a Napa Cabernet Sauvignon made by the Harlan family, was the Liv-ex 100’s best performer in March. Its ‘mid-price’, defined as the mid-point between the highest live bid and lowest live offer on Liv-ex, rose nearly 16%, versus February, to £7,600 (for 12x75cl in bond).

Promontory’s 2019 vintage (Decanter 99pts) was one of several wines recently released internationally via La Place de Bordeaux. UK merchant Lay & Wheeler offered it at £840 (1x75cl in bond).

Market for Bordeaux sluggish

Bordeaux has edged towards this year’s spring en primeur release season against a backdrop of quiet trading and declining fine wine prices on the secondary market.

Buyers still turned up for the recent release of Château Latour, Pauillac 2017. Sales were similar in quantity to Latour 2015, which debuted last year, said Joss Fowler, UK sales director at merchant Farr Vintners. Yet, Fowler added: ‘Demand for young Bordeaux is soft, as it is for wines from all regions.’

Trading on Bordeaux wines has been ‘extremely quiet’, said Matthew O’Connell, CEO of Bordeaux Index’s LiveTrade online trading platform. Bordeaux has lagged the price performance of other key regions in recent years, LiveTrade data shows. ‘We think [Bordeaux] is undervalued,’ said O’Connell, though he added it’s currently difficult to see a catalyst for growth.

Meanwhile at Liv-ex, a global marketplace for the trade, the bid-to offer ratio for Bordeaux wines was 0.4, close to a tenth of its peak level two years ago, said chief commercial officer Anthony Maxwell. Liv-ex’s Fine Wine 50 index, which tracks first growths, was down by 2.7% in value over five years, while the broad-based Liv-ex 1000 index was up 12.3%.

En primeur prices to fall?

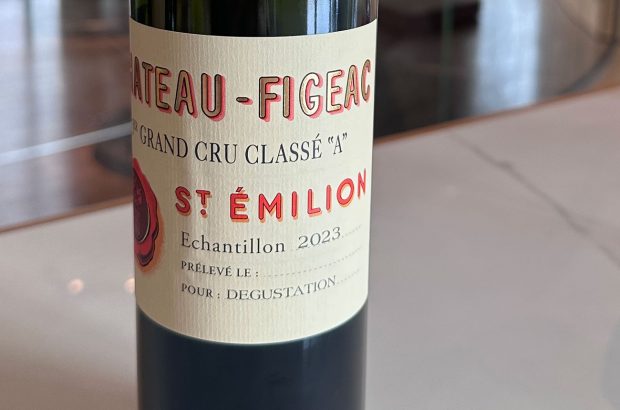

There was speculation in April that release prices will fall for Bordeaux 2023 en primeur wines, although each château has its own strategy and market context.

A report by analyst group Wine Lister said Bordeaux 2022 wines, released last year at ‘record high prices’ in some cases, have ‘so far remained stagnant on the secondary market, despite the noise around the high quality of the vintage’.

Farr Vintners’ Fowler told Decanter, ‘It’s a buyer’s market and the 2023 en primeur campaign will only be successful if it offers the consumer excellent value for money with prices below those of all physically available vintages in the market today.’

Liv-ex’s Maxwell said there was no shortage of quality wine available to buyers from recent vintages in Bordeaux and other regions. Nevertheless, Bordeaux’s en primeur campaign for the 2023 vintage could help to energise the market if release prices are deemed sufficiently attractive, he added.

The Bordeaux Index view

Fine wine & spirits specialist Bordeaux Index kindly sponsors this section of Decanter, and provides its view on the market here every issue. It can be found at bordeauxindex.com.

Headlines on Bordeaux in the last two to three years have tended to relate to En Primeur pricing rather than strong market price performance, which has been associated more with Burgundy and Champagne.

Bordeaux Index believes that Bordeaux is substantially undervalued, especially post the 2023 market price drift. The key wines are central pillars of the global fine wine market and the underperformance vs other regions seems significantly overdone.

However, elevated En Primeur pricing cannot lead the market higher – and indeed we have observed previously that it can have the opposite effect by muting engagement with the wines already in the market.

There would be great benefit to Bordeaux demand and secondary market prices from an En Primeur campaign which seeks to re-engage buyers. While that will not be made easier by the prevailing environment, we believe it is nevertheless possible given the right release pricing.