Like Brexit, Trump and Marmite, some things in life seem destined to be controversial. Two of them came together recently when the UK’s Football Association decreed that winners of the 2019 FA Cup, in a break with tradition, would not be awarded Champagne but ‘a non-alcoholic Champagne’ alternative. Needless to say, the announcement provoked much coverage and debate.

Low- and no-alcohol wine is something of an enigma. Legally, it doesn’t exist – officially, ‘wine’ should contain a minimum of 8% alcohol by volume (abv) unless specifically exempted. It tends to generate heated opinion. Traditionalists decry it as a needless abomination; others see it as an exciting part of wine’s future. Many rightly criticise lacklustre quality from examples to date.

There’s also a lack of clarity about what ‘low and no alcohol’ actually means, not helped by a confusing set of official UK designations, with four different terms used to describe wines of 1.2% abv or less. Much has been written about ‘lower-alcohol’ wines (between 6%-11% abv). But this piece will focus on wines of 0.5% abv or less (officially ‘de-alcoholised wine’, though I’ll refer to it as ‘low and no’ as per general parlance). Evidence indicates this category is increasingly the focus for producers, retailers and wine drinkers.

Going dry

In the UK, alcohol consumption is in long-term decline. The growing numbers taking part in Dry January (some 4.2 million in 2019) are one manifestation of a broader shift as people drink less. This trend is particularly notable among the young – surveys indicate that 29% of 16-24 year-olds are teetotal (up from 18% in 2005). But it’s a wider phenomenon too – a quarter of UK adults are looking to reduce their alcohol intake (YouGov/Portman Group poll, January 2019) and the proportion of adults who drink alcohol is at its lowest level on record: 57% in 2018, compared to 64% in 2005 (UK Office for National Statistics). It’s increasingly a case of ‘No booze please, we’re British’.

Various reasons are cited for the move away from alcohol. These range from the practical (driving) to the nutritional (fewer calories), procreational (pregnancy) or spiritual (religion). Among the young, dynamics include risk aversion in the age of social media, a lack of economic security (people tend to drink more when financially secure) and a desire to differentiate themselves from their heavier-drinking parental generation. For older demographics, health concerns increasingly come into play.

Drinks producers see an opportunity. Brewing giant AB InBev predicts 20% of its profits will come from low- or no-alcohol beer by 2025. Fellow drinks titans Diageo and Pernod Ricard have both tipped low and no drinks as key strategic aims. The proliferation of low- and no-alcohol beers has been matched by a rise in clean-living bars, from the Redemption chain in London to The Virgin Mary in Dublin (Sainsbury’s The Clean Vic pop-up wins best name). From a trial run of 1,000 bottles in 2015, ‘the world’s first distilled non-alcoholic spirit’ Seedlip has enjoyed stratospheric success despite a premium price point, revolutionising the no-alcohol category and spawning a host of imitators.

See also: France’s first ‘dry January’ causes a stir

Growing market

While low- and no-alcohol wines have not kept pace with beers or distillates, neither have they stood still. Market figures, scarce as they are, indicate 0%-0.5% wine to be a small but growing category worth about £27m in the UK – research by German producer Reh Kendermann with Kantar Worldpanel also shows 0%-0.5% abv wine as the fastest- growing sector, up 26%, with consumers identified mainly as over-45, regular wine drinkers looking to cut back during the week without sacrificing on ceremony or taste.

There is a general consensus that low- and no-alcohol wine is a trend for the future. ‘It’s set to become huge and we can’t ignore it,’ comments Pierpaolo Petrassi MW, Waitrose head of buying for beers, wines and spirits. Majestic has just launched its first 0% wine range. Marks & Spencer has doubled its low and no range over the last year as its wine sales in this category have risen 89%, while Booths and brewer/distiller Adnams are also aiming to grow the category. All identify the motivation for these moves as response to increased demand.

‘The appetite is there,’ comments M&S buyer Cat Lomax. ‘These are occasions and a clientele we perhaps overlooked from a wine- centric perspective before. But these products allow people to join in the fun even with an abstinence mentality, or have the benefit of a drink at the end of a hard day without the guilt.’

According to Booths wine buyer and DWWA judge Victoria Anderson, there’s a ‘scramble’ among wine producers to bring out low- and no-alcohol products. Some of these are own-label wines, with Germany’s Reh Kendermann and Spain’s Félix Solís being two major suppliers. Big brands such as Freixenet, Hardys, Martini and McGuigan have all launched products as of late. Many more are in the pipeline.

‘We identified this trend towards “responsible drinking” in mature markets 15 years ago,’ explains Miguel Torres Maczassek of Bodegas Torres. ‘So we started to experiment, launching Natureo 0.5% white in 2007.’ After positive feedback from markets such as Canada, Sweden and the UK, Torres added a red and a rosé to its range. ‘De-alcoholised wine doesn’t compete with classic wine, but [it does compete] with water, juice and soft drinks, which aren’t always ideal to match with food.’ He adds: ‘Food and wine – be it with or without alcohol – bring people together and help them enjoy life a little more.’

For German producer Johannes Leitz, who calls low and no wine ‘my special baby’, the process began with food, after a Norwegian restaurateur asked him for an alternative to Coca-Cola or fruit juice for drivers. From early on, Leitz decided to use good-quality base material for his Eins Zwei Zero Riesling, the loss in alcohol offset by residual sugar, ‘but not nearly as much as Coke or fruit juice’. Success duly followed: ‘In 35 years making top Riesling, travelling my ass off, I went from 20,000 bottles to 1 million. In just three years with non-alcoholic stuff, I’ve gone from zero to 200,000 bottles,’ he notes drily.

High ambition

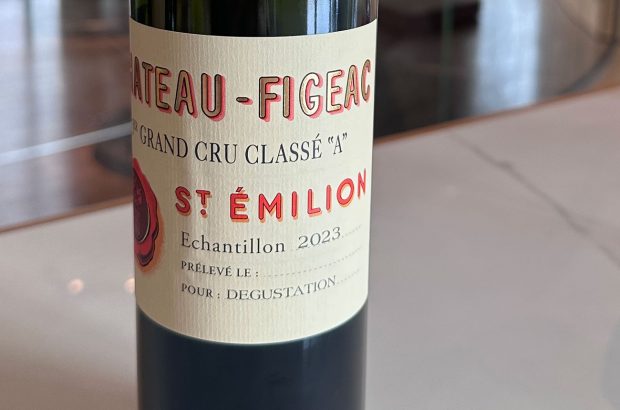

Having subsequently introduced a sparkling Riesling, Leitz is now mulling over the idea of producing low and no wines in cans (‘It’s a style that suits alternative packaging’) and is planning to produce a ‘high-end’ non-alcoholic Riesling from a top site, ‘more premier cru than village level’. This issue of fruit quality is a key one, as many poor-quality products seem to be made with sub-standard raw material. ‘Wine companies should be taking this seriously,’ asserts Waitrose’s Petrassi. ‘Perhaps it may take a Penfolds or a Château Margaux to part the Red Sea.’

This notion broaches an issue that is contentious for low- and no-alcohol wine: price. Some argue that such wines should be cheaper, since they avoid alcohol duty (taxes), and certainly many shoppers in this category seem price conscious. But others cite the example of the non-alcoholic distilled spirit-alternative Seedlip in establishing low and no drinks at a premium price and see investment in branding, packaging and winemaking as the keys to success.

‘Our aim is to [re]create all the luxury and ritual [around wine drinking],’ says Tessa John, who represents Maison Honoré du Faubourg, a non-alcoholic sparkling drink based on unfermented grape must priced at £20. Cecilia Prat at Chilean producer Sinzero comments: ‘Our wines use good fruit, which is the secret to quality wine, and that costs more.’ Stuart Elkington runs the online retailer Dry Drinker, which claims to stock the UK’s ‘largest range of non-alcoholic beers, wines and spirits’. He reports ‘decent’ take-up at premium price points, saying: ‘If you’re not drinking, sometimes you [still] want the best.’

Whatever your view, low- and no-alcohol wine seems here to stay. More and more products will be appearing to woo this growing market. It stands to reason that we wine lovers would happily avail ourselves of a low- or no-alcohol version of our favourite drink should we want to abstain, rather than having to turn to beer or cocktails. As long as it tastes good.

Whether such drinks will successfully replicate fine wine is another matter. Many perceive it to be a hopeless aspiration. Yet surely this is worth a moonshot or two from ambitious and imaginative producers (perhaps taking inspiration from non-wine sources). This will take time, patience, creativity and money. But, as the data indicate, there could be rewards aplenty for the pioneers.

In the meantime, as FA Cup winners happily go about dousing their teammates with non-alcoholic Champagne alternative, the magisterial Hugh Johnson has an alternative solution. ‘I drink spritzers,’ he muses, ‘and no one seems to mind.’

Low & no: top tips and ones to try

I’m still waiting for that eureka moment with low- and no-alcohol wine, but have been encouraged by developments of late. What I look for is an ability to pair with food, vinous characteristics, not being too sweet and a lack of off-flavours (particularly that raw pastry/damp cardboard hallmark of many low- and no-alcohol wines). This isn’t easy when a key ingredient like alcohol is removed.

One brand that has caught my eye is Sinzero from Chile. Its Reserva Cabernet Sauvignon 2018 (<0.5%, £9.49 Dry Drinker) shows typicity and complexity, and drinks well alongside a range of foods, with a touch of creamy oak and cassis concentration. Sinzero Brut sparkling (<0.5%, £9.49 Dry Drinker) is on the dry and tangy side but lacks the confected, sickly edge of others.

Certain styles seem better suited than others to low and no alcohol: fizz, rosé and refreshing whites particularly. Leitz, Eins Zwei Zero Sparkling Riesling (0%, £9.99 Jeroboams, Waitrose Cellar) is elegantly done, while Adnams, 0.5% Garnacha Rosé (£4.49 Adnams) is satisfying. Of the bigger brands, Freixenet, Legero Alcohol Free Sparkling Rosé NV (<0.05%, £5-£6 Morrisons, Ocado) slips down pretty easily, while Black Tower, Deliciously Light White (<0.5%, £3.99 Ocado) has decent texture and the Torres, Sangre de Toro 0% white (from £4.99 at Majestic) is refreshing and pure.